[PDF]

2000 Form 1040

Department of the Treasury-Internal Revenue Service 2000 Form 1040 US Individual

Income Tax Return (99) IRS Use Only-Do not write or staple in this space. For

...

16th

Amendment

US Federal Income Tax

Far reaching in its social

as well as its economic impact, the income tax amendment became part of the

Constitution by a curious series of events culminating in a bit of political

maneuvering that went awry. The financial

requirements of the Civil War prompted the first American Income Tax in 1861.

At first, Congress placed a flat 3-percent tax on all incomes over $800

and later modified this principal to include a graduated tax.

Congress repealed the income tax in 1872, but the concept did not

disappear.

After the Civil War, the growing

industrial and financial markets of the Eastern United States generally

prospered. But the farmers of the South

and West suffered from low prices for their farm products, while they were

forced to pay high prices for manufactured goods.

Throughout the 1860?s, 1870?s, and 1880?s, farmers formed such political

organizations as the Grange, the Greenback party, the National Farmers Alliance,

and the People?s (Populist) Party. All

these groups advocated many reforms considered radical for the times, including

a graduated income tax.

In 1894, as part of a high tariff bill,

Congress enacted a 2-percent tax on income over $4,000.

The tax was almost immediately struck down by a five-to-four decision of

the Supreme Court, even though the Court has upheld the constitutionality of the

Civil War Tax as recently as 1881.

Click Here

Although farm organizations denounced

the Court?s decision as a prime example of the alliance of government and

business against the farmer, a general return of prosperity around the turn of

the Century soften the demand for reform. Democratic

Party Platforms under the leadership of three-time Presidential candidate

William Jennings Bryant, however, consistently included an income tax plank, and

the progressive wing of the Republican Party also espoused the concept.

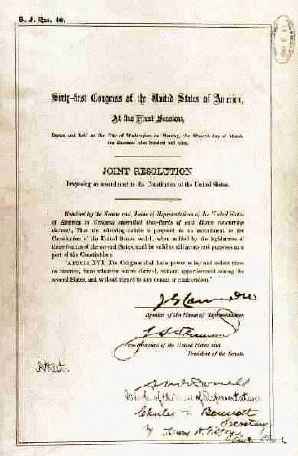

In 1909 progressives in Congress again

attached a provision for an income tax to a tariff bill.

Conservative, hoping to kill the idea for good, proposed a constitutional

amendment enacting such a tax; they believed an amendment would never receive

ratification by three-fourths of the states. Much

to their surprise, the amendment was ratified by one state legislature after

another, and on February 25, 1913, with the certification by Secretary of State

Philander C. Knox, the 16th amendment took effect.

Yet in 1913, due to generous exemptions and deductions, less than 1

percent of the population paid income taxes at a rate of only 1% of net income.

The full potential of the income tax for

revenue and for the redistribution of wealth was realized for the first time

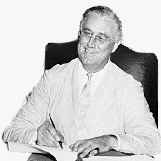

during the New Deal. President Franklin

D. Roosevelt declared ?our revenue laws have operated in many ways to the unfair

advantage of the few, and have done little to prevent an unjust concentration of

wealth and economic power.? The Revenue

act of 1935 popularly called the Wealth Tax Act, went a long way toward

remedying the evils described. It

provided steeply graduated personal income taxes up to 75% on income in excess

of $5 million. Wealthy Americans deplored

the leveling effect of a graduated income tax and called President Roosevelt a

?traitor to his own class.? Almost

immediately, income tax evasion became an important area of criminal activity.

President

Roosevelt signing Social Security Act into law, August 14, 1935

The income tax did not

directly affect most Americans until World War II:

In 1939 only 5 percent of Americans paid federal income taxes.

But the Revenue act of 1942 raised tax rates, lowered exemptions, and

created the Victory Tax of 5 percent on incomes over $624, broadening the income

tax base considerably. The new payroll

withholding tax was the greatest change for the majority of Americans. The

?pay-As-You-Go? tax plan, developed by Beardsley Ruml, the treasurer of the R.

H. Macy department store, was adopted in the Current Tax Payment Act of 1943.

The result of the new tax plan was that over 74 percent of Americans were

paying federal income taxes by 1945.

The income tax has become the most

important source of federal revenue. Without

it, the social reforms of the 1930?s, the financial costs of World War II,

national defense during the cold war, and the programs of the ?Great Society? of

the 1960s would have been impossible.? --- Published

For the National Archives and Records Administration by the National Archives

Trust Fund Board 1995

16the

Amendment to the Constitution - National Archives

NATIONAL

ARCHIVES:

National

Archives and Records Administration - documents the rights of

American citizens, the actions of federal officials, and the national

experience.

Research

Links

Virtualology is

not affiliated with the authors of these links nor responsible for each

Link's content.

Useful

Tax Links

ALTERNATIVE

MINIMUM TAX: Alternative

Minimum Tax - text of the U.S. Government code establishing the AMT.

CAPITAL

GAINS: Tax

Topic 409, Capital Gains and Losses - IRS

CHILDREN

TAXPAYERS: Publication

929, Tax Rules for Children and Dependents; Tax for Children Under Age 14 Who

Have Investment Income of More Than $1,400

INDIVIDUAL

TAX RETURN: 3.22.3

Individual Income Tax Returns

ESTATE

TAXES: Estate/Wealth/Gift

Statistics -IRS

and Publication

559, Survivors, Executors, and Administrators; Income Tax Return of an Estate--

Form 1041 and Publication

559, Survivors, Executors, and Administrators; Other Tax Information

FAIR

TAX: IRS

Tax Interactive - what is a fair tax

GIFT

TAX: U.S.

Estate and Gift Tax Law

PAYROLL

TAXES: [4.4.2] 5.6 Payroll Taxes

SOCIAL

SECURITY: Social

Security History Home Page - This is the history web site of the social

security administration with information on the history of Social Security

and the Social Security Administration.

TAX FORMS:

ARE AVAILABLE THROUGH IRS LOCAL

OFFICES, INTERNET, MAIL, COMPUTER, OR TELEFAX.

- Internet: Browse

and retrieve most Federal forms and publications from the IRS here..

These tax materials are available 24 hours a day, seven days a week.

- Office: You

may pick up forms or publications and even meet with IRS assistors for

answers to your tax questions at your nearest IRS office - Where

to File - IRS Offices. You can also call 1-800-829-1040

for recorded explanations that may answer your questions.

- Phone: IRS

forms line -- 1-800-TAX-FORM (1-800-829-3676) -- is open from 7:00 a.m. to

11:00 p.m., Monday through Saturday. You should know what forms you

want by number, and the name or number of the publication. Taxpayers should

allow up to 15 working days for telephone orders to be processed.

- Telefax: available

24 hours a day, seven days a week 703-368-9694 --

offers 144 forms with instructions by return fax. You can request

that the system fax a list of available items or you can find the order

numbers in the various tax instruction booklets.

TAX

HISTORY: Tax

History Project at Tax Analysts - providing scholars, policy

makers, and the media with information on the history of American taxation

and Tax

World - explanations of tax policy, history, courses,

glossaries downloadable forms and a great menu of links to other important

sites.

W-2

FORM: 21.3.6.4.7.1 Form W-2 Information

W-4

FORM: Part

3 Revenue, Returns, and Accounts Processing Chap. 29 ISRP System Sec. 92 SC

Processing of Form W-4 Employees' Withholding Allowance Certificate

File

Manager For Forms - IRS

[PDF]

2000 Form 1040

Department of the Treasury-Internal Revenue Service 2000 Form 1040 US Individual

Income Tax Return (99) IRS Use Only-Do not write or staple in this space. For

...

DogWare: 1040-DOG Income Tax

Form

This form is copyrighted. Please respect US/International

copyright law. This form is copyrighted ...

1999 California Income Tax

Forms and Instructions

... This booklet contains: Form 541 - 1999 Fiduciary Income Tax Return; FTB

3885F - 1999

Depreciation and Amortization; Schedule D (541) - 1999 Capital Gain and Loss;

...

Individual

Income Tax Forms

... 1997 Individual Income Tax Forms and Instructions. Form IT-511 Individual

Income

Tax Booklet - Form 500 only, IT-511. Form 500 Individual Income Tax Return. ...

Individual Income Forms

Page

... R-11/2000) 2000 Form MO-1040A — Single/Married with One Income Tax Return

— Short

Form and Instructions (R-11/2000) 2000 Form MO-1040B — Married Filing ...

WV Tax Commission -

Personal Income Tax Forms

... Non-Resident/Part-Year Resident Income Tax Form/Income &

Adjustments/Credit for

Income Paid to Another State (Form Only) (See Administrative Notice 97-25R). ...

Is the Income Tax

a Form of Slavery?

LewRockwell.com. Is the Income Tax a Form of Slavery?

by Steven Yates and Ray E. Bornert ...

1999 Federal Income Tax Form

1040 (Excel 5.0 Spreadsheet) ...

... This 1040 income tax form you have on the web is great! Just what I was

looking

for. You did an excellent job. Thank you. Jim D. (Texas). ...

Oklahoma Income

Tax Forms

... 511 Form, Individual Resident Income Tax Return (form only). 511EZ

Form, Individual EZ Resident Income Tax Return (form only). ...

Income tax advice and 1040 tax form

returns

... We Provide . . . . . expert income tax advice for 2000 1040 tax form

returns. .

. . income tax information needed for increasing your income tax deductions ...

2000

Massachusetts Income Tax Forms and Schedules

... Form 1: Massachusetts Resident Income Tax Return, Schedules and

Instructions. ... Form

2: Massachusetts Fiduciary Income Tax Return, Schedules and Instructions. ...